Change transforms

Signals which quantify how time series change over time.

- signal.change(*, method='auto', relative_to=None, limit, days, weeks, months, years)

Calculate the absolute difference between the signal’s value and the value at a prior date. The prior date is determined by an offset specified in years, months, weeks or days.

The

methodargument specifies how we find the prior data point to subtract. When themethodargument is:'ffill'we forward fill the prior data a maximum oflimitdays to match the dates.'bfill'we backfill the prior data a maximum oflimitdays to match the dates.'nearest'we move the prior data forward or backward a maximum oflimitdays to match the dates. We match with the prior data point which is moved the shortest.Nonewe do not move the past data at all.

When the

methodargument is'auto'we select the method and limit based on the given offset (unless they are explicitly set). The method and limit is:'nearest'and 31 days if the offset is more than or equal to 3 months'nearest'and 10 days if the offset is between 1 and 3 months'ffill'and 10 days if the offset is less than 1 month

These defaults are chosen because forward filling is more suitable when calculating the short-windowed change in, for example, the close price, while the lenient matching of the

'nearest'method is more suitable for less frequent data like quarterly data.- Parameters:

method – The method to use when matching with past data points, either

'auto'(default),'nearest','ffill'/'pad','bfill'/'backfill'orNone.relative_to – An optional signal to use for the values at the prior date.

limit – The limit on how far the matching method can move the data points.

days – The number of days between current and prior period, for example

days=1.weeks – The number of weeks, for example

weeks=3.months – The number of months, for example

months=12.years – The number of years, for example

years=1.

Example:

To get the day-over-day change in closing share prices:

close_price.change(days=1)

Note that forward filling with a limit of 10 days is the default for such short offsets, so the value on a Monday will be the change against the price on the previous Friday.

- signal.relative_change(method='auto', relative_to=None, limit, days, weeks, months, years)

Calculate the relative change between the signal’s value and the value at a prior date. The relative change is calculated as:

(current_value / prior_value) - 1

The prior date is determined by an offset in years, months, weeks or days.

See the above

signal.change(...)documentation for an explanation of themethodandlimitarguments.- Parameters:

method – The method to use when matching with past data points, either

'auto'(default),'nearest','ffill'/'pad','bfill'/'backfill'orNone.relative_to – An optional signal to use for the values at the prior date.

limit – The limit on how far the matching method can move the data points.

days – The number of days between current and prior period, for example

days=1.weeks – The number of weeks, for example

weeks=3.months – The number of months, for example

months=12.years – The number of years, for example

years=1.

Examples:

To calculate YoY relative change on Visible Alpha reported total revenue:

va_actual('Total revenue').relative_change(years=1)

To calculate YoY predictions for a KPI model (substitute your own model ID) that predicts Visible Alpha total revenue:

kpi_predictions(model=123).relative_change(relative_to=va_actual('Total revenue'), years=1)

Note that without specifying relative_to, the YoY relative change would be calculated versus model predictions from the year before, rather than versus the actual reported revenue.

- signal.yoy_holidays(country, window, years=1, *, min_periods=1, min_denominator=1e-6)

Calculate the year-over-year ratio for a signal, adjusted for holidays.

Note that this returns a ratio, so a value of 1.1 represents a 10% increase. You should subtract 1 to get the year-over-year change.

The year-over-year ratios are calculated by calculating a moving average whose length is given by the argument

window, and dividing it by the corresponding moving average from last year.However, some modifications are applied to the data in order to account for the effects of movable holidays. That is, if the moving average window this year contains, say, Black Friday, the corresponding moving average window for last year is adjusted so that it, too, contains Black Friday.

Currently, only the holidays for the United States and Norway are supported. The days that are treated as holidays for the United States are all the federal holidays in addition to Black Friday and Cyber Monday.

- Parameters:

country – The country whose calendar should be used to determine holidays. Currently only

USandNOare supported.window – The number of days in the moving window when calculating the moving average. This can be 1 or any integer divisible by 7. The default is 1.

years – The number of years between the window used in the numerator and the denominator

min_periods – The minimum number of non-NaN values present (in each of the numerator and denominator) required. If there are fewer non-NaN values than this, NaN is produced.

min_denominator – Produce NaN if the sum of the values in the denominator is smaller than this.

Example:

To get the year-over-year change in a signal with a seven-day moving average window:

signal.yoy_holidays(country='US', window=7) - 1

- signal.agg_change(freq, method, *, upsample_daily=False, min_points=1, \ last_period_days=None, last_period_fraction=None, allow_partial_start=False, allow_partial_end=False, weeks=None, months=None, years=None, fiscal_entity=None)

- signal.agg_relative_change(freq, method, *, upsample_daily=False, min_points=1, \ last_period_days=None, last_period_fraction=None, allow_partial_start=False, \ allow_partial_end=False, weeks=None, months=None, years=None, fiscal_entity=None)

Aggregate a high-frequency signal to a given frequency, then calculate absolute or relative change.

By default, sequential change is calculated. Sequential change is change since the last equivalent period, which for a quarterly frequency corresponds to quarter-over-quarter change and for an annual frequency corresponds to year-over-year change. Change may optionally be calculated relative to a period that is a multiple of the frequency in the past. Use the arguments

weeks,monthsandyearsto control this. For example, to aggregate data to a quarterly frequency and then calculate year-over-year change, usefreq='Q'andyears=1.The last period typically has partial data (only data in the beginning of the period) and there are different ways of handling this period:

Do not include the period in change calculation. This is the default behavior.

Period-to-date calculation. Specifying

last_period_daysorlast_period_fractionenables period-to-date calculation. When doing period-to-date calculation, the change for the last period is calculated by determining the fraction of days for which there is data in the last period and comparing it to the same fraction of days in the comparable period. Themin_pointsconstraint does not apply to the last period and its comparable period when doing period-to-date calculation.Normal change calculation. Setting

allow_partial_end=Trueenables normal change calculation for the last period with partial data. The last period is then subject to themin_pointsconstraint as any other period.

If

upsample_dailyis set to True, the underlying signal is upsampled to daily frequency before downsampling to the desired frequency. If the method issumormean_times_days, the upsample operation usesdivide=True. If the frequency of the underlying time series is not detected, it is assumed that the time series already has daily resolution, and it is not altered before the downsampling.Note that if the frequency of the original data does not evenly divide the frequency being converted to, (e.g. weekly data converted to quarterly) it is recommended to set

upsample_daily=True.Whenever weekly, monthly or quarterly data is converted to fiscal frequencies (

'FQ'or'FQ/FS'or'FY') it is also recommended to setupsample_daily=True, as any calendar period may cross two fiscal periods.- Parameters:

freq – A frequency, for example

MorFQ.method – Method to use for aggregation. Standard Pandas methods like

'mean','median','sum'are supported, as well as the special'mean_times_days'method.upsample_daily – Whether to upsample the data to daily resolution before downsampling.

min_points – Minimum number of points needed in order to calculate an aggregated value for a period. Note that if

upsample_daily=True, the data points are counted after the upsampling, so the requirement applies to the number of daily data points.last_period_days – Day threshold for enabling period-to-date calculation for the last period with partial data. If specified, the number of days from the period start to the last non-NaN data point must be equal to or greater than the specified value. It is only allowed to specify one of

last_period_daysandlast_period_fraction.last_period_fraction – Fraction threshold for enabling period-to-date calculation for the last period with partial data. If specified, the fraction of days, calculated as the number of days from the period start to the last non-NaN data point, divided by the total number of days in the period, must be equal to or greater than the specified value. It is only allowed to specify one of

last_period_daysandlast_period_fraction.allow_partial_start – Whether to include a period with partial data at the start of the period in the change calculation. A period has partial data at the start of the period if there are no non-NaN data points on or before the period start date.

allow_partial_end – Whether to include a period with partial data at the end of the period in the change calculation. A period has partial data at the end of the period if there are no non-NaN data points on or after the period end date. It is not allowed to set this to True if

last_period_daysorlast_period_fractionis not None.weeks – The number of weeks to determine the change offset.

months – The number of months to determine the change offset.

years – The number of years to determine the change offset.

fiscal_entity – The entity whose calendar should be used to determine the fiscal periods. Only relevant if

freqis a fiscal frequency. By default, the calendar of the evaluation entity is used.

Examples:

To sum up a signal to fiscal quarters and calculate quarter-over-quarter absolute change, use:

signal.agg_change('FQ', 'sum')

To upsample a signal to daily resolution and sum it up to fiscal quarters or semi-annual periods and calculate the year-over-year relative change, use:

signal.agg_relative_change('FQ/FS', 'sum', years=1, upsample_daily=True)

To sum up a signal to forced fiscal quarters and calculate quarter-over-quarter relative change, where we require at least 70 days with data in each quarter and data for the first 15 days in the last partial quarter, use:

signal.agg_relative_change('FQ+', 'sum', min_points=70, last_period_days=15)

To take the monthly sum and calculate month-over-month relative change, where we require data for at least half of the last month, use:

signal.agg_relative_change('M', 'sum', last_period_fraction=0.5)

To take the weekly sum and calculate week-over-week relative change, allowing a partial start and partial end, use:

signal.agg_relative_change('W', 'sum', allow_partial_start=True, allow_partial_end=True)

- signal.change_relative_to(from_signal, periods, pre_extend_months, \ shift_offset_days, shift_offset_months, shift_offset_tolerance_days, relative_change)

Calculate the change of one signal relative to the past values of another signal.

Note: this signal is deprecated, use

signal.change(...)orsignal.relative_change(...)with therelative_toargument instead.There are two ways of calculating the change:

Using the

periodsargument: Thefrom_signalis re-indexed to the index ofsignaland the values are shifted by the given number of periods before the change is calculated.Using the

shift_offset_days/shift_offset_monthsarguments: The index of thefrom_signalis shifted by the given offset and then re-indexed to the index ofsignalusingmethod='nearest'to match the nearest value.shift_offset_tolerance_daysspecifies the maximum number of days a value can be moved when determining the nearest value. If there are two data points in thefrom_signalwith the same distance to a data point insignal, the newest one will be used.

Note that for signals that may produce time series with missing values, it is preferable to use

shift_offset_days/shift_offset_months. This method takes into account the absolute number of days a value can be shifted, whereas theperiodsmethod will blindly shift values.All arguments except for

signalare optional. If no other arguments thansignalare given,periodswill be used with a default value of1.- Parameters:

from_signal – The signal to calculate the relative change from.

periods – The number of periods to shift the

from_signal. The default value isNone.pre_extend_months – If

periodsis used, this specifies the number of months to pre-extend the signal evaluation period. The default value isNone.shift_offset_days – The number of days to shift

from_signal. The default value isNone.shift_offset_months – The number of months to shift

from_signal. The default value isNone.shift_offset_tolerance_days – If

shift_offset_days/shift_offset_monthsis used, this specifies the maximum number of days a value can be moved when determining the nearest value. The default value is31.relative_change – Whether to calculate the relative change. Set to

Trueto calculate relative change andFalseto calculate actual change. The default value isTrue.

Example:

Calculate the year-over-year relative change in sales:

fs_actual('sales').change_relative_to(fs_actual('sales'), shift_offset_months=12)

- signal.cagr(years, months, weeks, days)

Calculate the CAGR (compound annual growth rate) of the signal, over the given interval.

Exactly one of the arguments

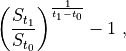

years,months,weeksanddaysshould be provided, and it must be a positive integer.The CAGR of a time series S, calculated over an interval from t0 to t1, is calculated as

where t1- t0 is measured in years. If the difference between t0 and t1 is one year, this is the same as the year-on-year relative change.

Example:

Calculate the CAGR of FactSet sales over the last 5 years:

fs_actual('sales').cagr(years=5)